In his interview to business portal UAprom he told about the Company’s plans to develop a line of pipes for the “green” economy and growth in the passenger wheels segment.

- Describe please Interpipe's current product strategy? Recently you said that you want to develop a product line in market niches that are emerging due to the decarbonization trend. Tell us more about your plans in this area.

- Interpipe is moving towards expanding its product portfolio and unique solutions. We are constantly looking for new segments and working on developing complex products, as this approach will help us gain more added value and create a competitive advantage, favorably distinguishing us from the standard products offered mainly by China.

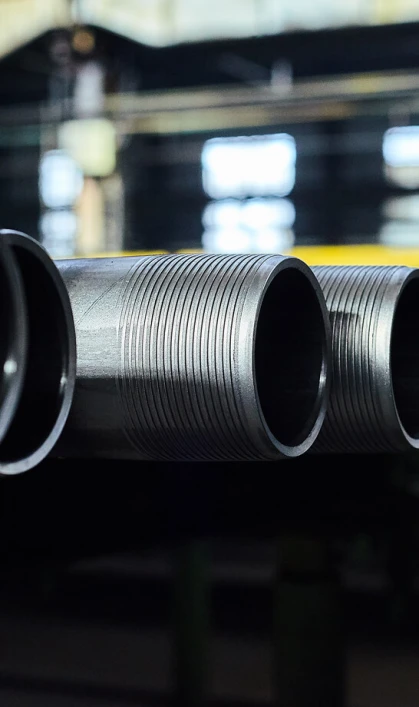

For example, we have identified several promising areas for pipe production. These are geothermal pipes, which are increasingly used for heating systems in the European countries. In addition, we are considering the development, production and entry into the market of pipes for the construction and maintenance of carbon capture storage (CCS) as well as for infrastructure of hydrogen production and transportation. The construction of pipelines around these facilities will require pipes with specific requirements for the chemical composition of cast steel and physical characteristics. This could be a promising development for Interpipe.

- What markets and volumes are you targeting?

- Decarbonization is a trend that has a significant impact on the market in the European Union. In the US, for example, the construction of carbon storage facilities is not even discussed at a serious level. But even in Europe, the “green” product market is only forming now, so it is difficult to measure it.

At this stage, development and growth depend on several factors: from the regulatory framework to the volume and speed of investments in hydrogen production projects, and the willingness to invest in the construction of carbon storage. While hydrogen projects generally have a positive trend, carbon capture and storage capacities have a longer-term perspective. Several projects have been built in the Scandinavian countries so far, and the main bulk is at the design stage.

Spot purchases can be observed for individual projects. But this is still not systematic and large-scale construction. It is still unclear what the real investments in these and similar projects will be. Also, much will depend on the sustainability of decarbonization policies in Europe. If the “green” agenda changes, then, accordingly, the market volume will also differ significantly.

The situation with geothermal pipes is clearer. The total volume of this market in Europe is about 50 kt and we see a growth potential up to 80-90 kt, especially in Germany.

It is also important to note that we plan to develop all products focusing on the EU trade policy. If Brussels nevertheless decides to reduce quotas for steel import, including for Ukraine, this will severely limit us. In this case, we will determine the target sales volumes of these products within the quotas we’ll obtain.

- Will the development of these products require additional investments from Interpipe?

- At the moment, we believe that the development of these product segments won’t require significant additional investment from us, except costs for R&D. We already have all the technical capabilities, including due to the modernization of the heat treatment department at the pipe production facility in Nikopol amounting to approximately $40 million. Therefore, in 2026-2027, we plan to focus on their development and certification in order to be able to enter the market with finished products in the future.

Actually, we already manufacture some types, for example, geothermal pipes, and are expanding the geographical coverage of sales. Several manufacturers already have analogues for hydrogen pipes. Therefore, we simply need to make our own product at the available facilities and certify it. But CCS-pipes are definitely a new design. Their production has yet to be mastered, and this process may be more complicated than with hydrogen pipes, since this product will require its own non-standard steel, selection of rolling modes and heat treatment. We will consider them based on specific specifications.

- You told about Interpipe’s plans to further expand its product portfolio. What other niches do you plan to enter?

- In the pipe segment, we are working on products for nuclear power plants, mainly boiler tubes. Another large group of products is pipes for drilling oil and gas in acidic environments, which aren’t in Interpipe's portfolio yet. Such pipes, due to their specific geology and climate, are in demand in Canada and the USA, Europe and the Middle East, but we are primarily focused on the North American market.

A separate sphere is drill pipes which are actually a component of wells for production oil or gas. These products are significantly different from the range that we currently offer to customers, in particular, casing and tubing. Its development will require additional investments from the company. Accordingly, this project is currently under consideration by top management, and everything is going to the point where the necessary investments will be confirmed, and work will be started.

Here we are talking about supplementing the existing production configuration with additional equipment, so the amounts are not significant on the scale of the enterprise. For example, we already have additional new equipment for tubing, which can also produce drill pipe bodies. But, to establish full-fledged drill pipe production, we will need to invest another 3-4 mln. USD in a separate finishing installation for welding special locks.

- What are Interpipe's development plans in the railway product segment?

- Interpipe has been working for the last 10 years to establish itself in the European freight wheel market, and the Company has consistently been a key player in this segment under the KLW brand.

Now the Interpipe's main focus and strategy are concentrated on the passenger wheel segment, where there are more stringent requirements for wheel geometry, mechanical properties, and design.

Passenger wheels also vary depending on the type of car and speed mode. For trains moving at medium speed (120-160 km/h), for high-speed ones (up to 220 km/h and up to 330 km/h), respectively, there are other requirements, for metro or trams these requirements may differ significantly.

Therefore, in order to expand its product portfolio in the passenger segment Interpipe is already implementing an investment program, which the Company presented this year during the Ukraine Recovery Conference 2025 in Rome, to modernize and expand the production of wheels and wheelsets for the period until 2032 for a total amount of 120 mln. USD.

Its main projects are the construction of a new heat treatment department, expansion of wheel and axle finishing capacities, and modernization of the workshop infrastructure at Interpipe NTRP in Dnipro. Moreover, each stage of modernization will necessarily have a strong environmental component: from reducing CO2 emissions to increasing energy efficiency in all our operations, which will strengthen our export positions thanks to a new level of quality.

Developing new niches will also require significant efforts from Interpipe’s team to go through the qualification process with our products within key operators and railcar builders. This is a complex process that can take from three to five years.

- As far as I know, Interpipe already has separate contracts for the supply of wheels specifically for passenger transportation with companies such as Alstom and Siemens...

- Yes, we have already supplied small volumes to Alstom in India and other projects, as well as for Siemens trains that serve urban transportation. Interpipe has provided wheels for many urban projects around the world, such as the Chicago subway, or have collaborated with Deutsche Bahn.

However, the share of passenger wheels in Interpipe's railway product sales is still very small, and to increase it we need to modernize our production facilities. We expect that due to the planned investments we will be able to grow in the passenger wheel segment, primarily in the European Union, as it is our domestic market.