For normal market planning, and not just working on spot markets, electricity importers must have a guarantee that they will be able to supply resources to Ukraine. Currently, only short-term contracts are available for booking interstate crossings. Holding auctions for access to crossings for longer periods of time will balance the markets and make their activities more predictable. GMK Center quotes the speech of Vasyl Goncharuk, director of Dniprostal-Energo LLC, at the round table “Ukraine’s electricity market: challenges for industry and the iron and steel complex.”

The problem of rising electricity costs

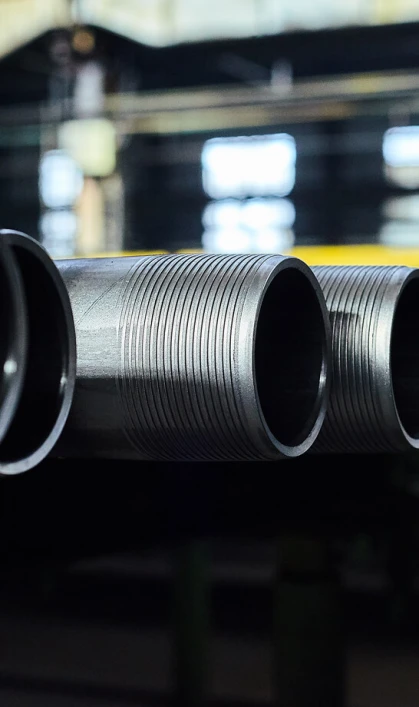

The increase in electricity tariffs is a critical factor for export-oriented industrial enterprises. In particular, for INTERPIPE, a leading producer of pipe and railway products. The increase in its cost significantly reduces our competitiveness in foreign markets.

According to our calculations, the latest increase in price caps will lead to a 26% increase in electricity prices for our enterprises. This will have a particularly negative impact on the prospects for our electric steel smelting facilities, which consume huge amounts of electricity.

Formal arguments and real conditions

The increase in price caps is explained by the integration of the Ukrainian market into the European model and the creation of conditions for electricity imports. However, in both cases, there are fundamental objections.

In Europe, price caps perform a technical rather than a price-setting function. There are also long-term pricing instruments in place – quarterly, semi-annual, or annual contracts that allow prices to be forecast and fixed. In Ukraine, such instruments are virtually non-existent.

We also lack transparency: information about the deficit or surplus of electricity in the system is limited or appears in the form of rumors and unverified information. In such conditions, raising the upper price cap only forces traders to insure themselves by purchasing resources at the maximum price. As a result, the price cap turns from a technical restriction into an actual market maker that shapes the market price.

For their part, European markets provide access to information through insider information platforms regarding shortages or surpluses in the energy system. This means that the supplier-trader has the information to make certain decisions about their position and the state of the market, which makes it possible to correctly predict the price both in the portfolio and their position on the spot markets.

Imports: potential without a mechanism

An increase in prices on the domestic market does not in itself guarantee electricity imports. The existence of a potential price difference does not equal guaranteed supply. Real imports require long-term access to interstate crossings – for a quarter, six months, or a year. Only in this case can traders attract imported resources not only from current spot markets, but also on the basis of forward contracts, forming a balanced portfolio.

Today, trading operates on a day-to-day basis, which makes it impossible to plan imports in advance. How can you sign a “long” contract and look for resources if you cannot actually supply them to Ukraine? And something needs to be done with these resources in the exporting country. This is a significant risk that deters importers.

If Ukraine really integrates into the European energy market and moves to a fully liberal market model, conducting market cap, it is necessary to implement all the appropriate tools:

- long-term contracts;

- accessible information exchange platforms;

- market forecasting.

Simply raising the price cap without all the accompanying tools is shifting the burden onto the consumer, not market liberalization.

Public consultations and procedures

Another important aspect is the lack of a real mechanism for discussing tariff increases. For example, due to martial law (in accordance with the requirements of NEURC Resolutions No. 848 of 09.05.2023 and No. 349 of 26.03.2022), discussions on electricity distribution tariffs (EDT) in August this year is taking place without the participation of consumers. Comments can only be submitted in writing to already prepared draft resolutions. For example: “it was 1 UAH, now it is 1.20 UAH” – without any explanation of the rationale or details of the calculations. In such conditions, the influence of consumers on decision-making is minimal, and the transparency of the process is questionable.