In May 2025, after a year and a half hiatus, Ukrainian Railways (UZ) resumed auctions for the sale of scrap. This is a good opportunity for the state-owned company to improve its difficult financial situation. However, trading in raw materials is still not very effective, with auctions often failing due to a lack of participants. GMK Center looked into the reasons for this situation and what Ukrainian Railways is doing to remedy it.

The importance of Ukrainian Railways’ scrap

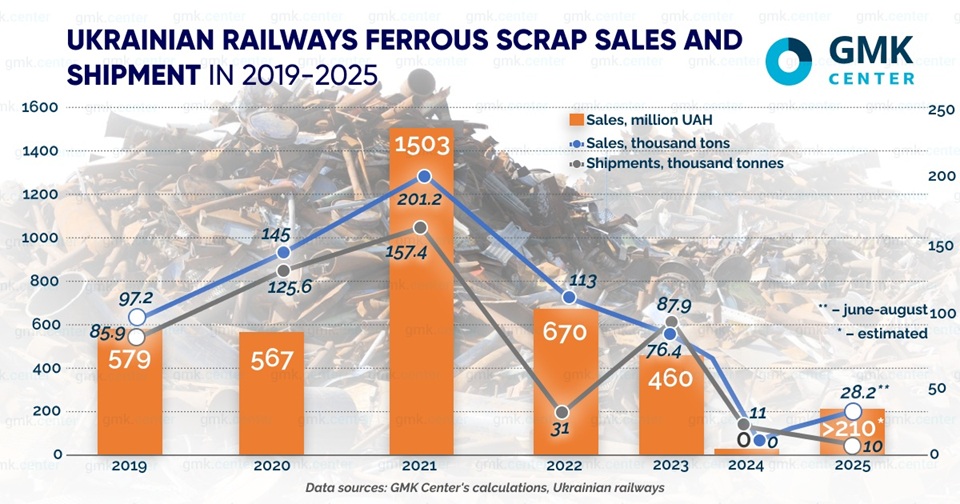

Ukrainian Railways is the most important source of high-quality scrap for the Ukrainian steel industry. Previously, Ukrainian Railways’ scrap accounted for an average of 10–15% of the total volume of raw materials consumed by Ukrainian steel plants. This figure was calculated based on Ukrainian Railways’ sales on the Prozorro. In reality, based on actual shipments of raw materials to steel plants, the share of UZ scrap rarely exceeded 6%.

However, the importance of this source of raw materials has now become more significant against the backdrop of an overall decline in scrap collection in Ukraine due to the war. While scrap collection averaged over 4 million tons per year until 2021, this figure fell to 1.3 million tons and 1.7 million tons in 2023 and 2024, respectively. Moreover, a significant portion of this resource is being “washed out” of Ukraine by raw material exports.

Since September 2023, Ukrainian Railways has stopped holding auctions for the sale of scrap due to a legal conflict in legislation and its own inflexibility, which is characteristic of all post-Soviet state-owned companies with an extensive bureaucratic apparatus.

After resuming auctions, Ukrainian Railways held 77 auctions in June-August, selling 28,200 tons of raw materials. At the same time, actual shipments of scrap from UZ sites were, of course, lower than “paper” sales, falling to a seven-year low of only 10,000 tons. Unfortunately, this is significantly less than both previous periods and UZ’s potential capabilities.

Nevertheless, Ukrainian Railways says that a significant break in the bidding allowed it to accumulate significant volumes of raw materials: 95.5 thousand tons of scrap has already been prepared for sale, and in the foreseeable future another 131 thousand tons of raw materials may be available. And the planned sales volume of UZ for 2026 is about 200 thousand tons of ferrous scrap.

It is important to note that currently Ukrainian Railways is much more interested in selling raw materials than ever before due to its critical financial situation. Because of this, the Cabinet of Ministers in May was forced to urgently allocate to UZ from the reserve fund more than UAH 4.3 billion of financial aid, which actually went to pay salaries. In turn, Ukrainian Railways is in urgent search for internal reserves to obtain funds, and selling scrap and then shipping the sold goods on time is one of the most understandable and affordable options.

Existing obstacles

GMK Center surveyed scrap market participants about the problems that prevent Ukrainian Railways from more successful scrap sales and formulated the following problems:

1. The starting prices at the auctions do not correspond to the current market conditions.

Market participants complain that the initial scrap prices at Ukrainian Railways’ auction are significantly higher than the market level, which deprives the purchase of raw materials of economic feasibility. The reason for this imbalance is that for several months, UZ has been focused on April prices, when the scrap market was on the rise.

«UZ puts out starting prices of auctions based on the certificate of “Ukrpromvneshexpertiza” issued back in April this year. Now these price levels are not market levels, because they have significantly decreased since then. Therefore, the starting prices should be brought to market prices: both in numerical terms and in the number of additional services imposed by UZ. Today, the total cost of UZ’s scrap buyer is 37.5% higher than the starting price of the lot at the auction. These +37.5% make up more than eight different positions of services that cannot be determined in advance,» Valentyn Makarenko, chairman of the board of Interpipe Vtormet, told GMK Center in a commentary.

Moreover, the lot price is only a part of the total cost. As Ivan Kovalevsky, CEO of Metinvest-Resource, noted in his commentary to GMK Center, the final sum is made up of the auction price of the scrap itself, the 5% Prozorro commission for participation in the auction, clogging, loading and delivery costs. Because of this pricing policy of Ukrainian Railways, it is unprofitable for plants to buy scrap.

2. The cost of loading services is too high.

The cost of loading in Ukrainian Railways is overstated relative to the market price, which is on average 300-500 UAH per ton, while in UZ this service costs up to 1.2 thousand UAH. This leads to the fact that the auction price of scrap with the cost of loading turns out to be higher than the market price.

«The price that UZ offers to the domestic market does not meet the current market conditions, so we do not participate in such bidding. I will give a concrete example. Today Kametstal buys scrap at the price of UAH 8 thousand per ton including delivery by motor transport directly to the plant. Scrap with delivery by railroad to the same place costs UAH 7.6 thousand. At the same time, Ukrainian Railways puts the bidding price at UAH 7.2 thousand, to which it is necessary to add UAH 1.5 thousand for loading and unloading works. The total turns out to be UAH 8.7 thousand at the market price with delivery by rail of UAH 7.6 thousand,» Konstantin Bass, chairman of the supervisory board of Ukrmet Group of Companies, told GMK Center in a commentary.

At the same time, there is an additional problem. According to Ivan Kovalevskyy, although officially self-disposal of scrap from the territory of UZ enterprises is prohibited, some companies circumvent this norm. They sign contracts with Ukrainian Railways for the purchase of scrap with loading, and then refuse it and take the scrap by self-delivery. For them, the cost of loading is 200-300 UAH per ton, which makes the purchase of raw materials 1000 UAH cheaper than for other buyers, which undermines fair competition.

3. The payment terms are not in line with market practice.

Since independent loading of scrap by buyers is impossible due to the regime of UZ facilities or impossible in volumes for mass shipment, the business proposes to switch to FCA terms (goods loaded into the seller’s vehicle and handed over to the carrier) instead of the current EXW system (shipment from the seller’s warehouse) and in addition separate payment for loading scrap. This seems logical as the entire Ukrainian scrap market operates on FCA terms.

«This requires correction, because such conditions of shipment to the seller and with payment by buyers of a mass of additional services lead to an even greater increase in the cost of scrap and, accordingly, to a decrease in the economic feasibility of buying it from Ukrainian Railways and, most importantly, to non-transparent relations and lack of guarantees of receipt of goods on time», emphasizes Valentyn Makarenko.

Significant, but less significant problems of potential buyers of railroad scrap are the following:

- too small lot sizes, which significantly increases lot administration and execution;

- lack of clear codification and sorting of scrap by type, which leads to difficulties in realization of mixed lots;

- divisions of Ukrainian Railways are differently provided with technical means for loading scrap.

There are also legal problems, which also do not contribute to mutual understanding between the state carrier and cargo owners.

«It is impossible to change the contract with UZ in any way, in particular clauses 5.3 and 5.4, which provide for an unfair level of liability for non-compliance with the terms of the contract. In case of violation, the client’s liability is hundreds of times higher than that of UZ. Such things are not conducive to normal cooperation,» Sergiy Krokhmal, CEO of Lyon-Agro LLC, emphasized in his comments to GMK Center.

There are also inconvenient moments for buyers in terms of transportation. The contract stipulates that scrap can be picked up only by road or rail – without the possibility of combining.

«This creates significant problems if the customer cannot pick up a certain balance of scrap, for example, that does not fit into a freight car. This residue then becomes a problem for Ukrainian Railways itself. What is the problem of allowing to remove the residue by motor transport, if the main batch I take out by rail?» Serhiy Krokhmal notes.

Problem solving

For its part, Ukrainian Railways is trying to at least partially solve the existing problems. UZ announced a significant part of its intentions at a September meeting with scrap market participants, where problematic aspects of the raw material sale process and options for their solution were discussed.

In order to actualize initial prices at auctions, Yevhen Shramko, a member of the Ukrainian Railways board, promised at the September meeting that he would periodically order price reports in case of significant market fluctuations. However, given the volatile market conditions and non-urgent preparation of trades, it is likely that similar problems will arise in the future, albeit with less regularity.

«The initial value of scrap is determined on the basis of certificates from government agencies and specialized companies providing expert estimates of market prices. The price is formed on the average minimum level taking into account the clogging according to the norms of DSTU, but cannot be lower than the level of book value. Currently, such certificates are ordered from specialized companies, after them the issue of revision of starting prices will be considered,» Ukrainian Railways noted in the commentary of GMK Center.

To address the problem of high scrap loading prices, UZ plans to introduce five groups of tariffs depending on location, which was agreed at a meeting in September. UZ now operates more than 300 shipping points across Ukraine, which have different fixed costs and technical capabilities for loading scrap. Loading prices are expected to range from UAH 300 per ton to the current level of more than UAH 1,100 per ton.

Also in Ukrainian Railways promised to realize such an opportunity in stages, as it requires numerous internal approvals. At the same time, the provision of FCA shipment conditions is not a novelty for the state-owned company.

Until 2019, UZ operated, like the rest of the market, on FCA terms, and then, as an experiment, proposals were made to switch to EXW terms. It must be said that these terms of sale of scrap have been deteriorating and becoming more complicated for buyers, and have now led to their rejection.

In addition, at the September meeting it was decided to codify certain types of scrap (rails, car axles, solid rolled wheels) and form separate prices for them. At the same time, Ukrainian Railways’ lots, as before, will include different types of raw materials – both demanded and less attractive.

Also, Ukrainian Railways has already changed its approach to announcing auctions: scrap lots of ferrous (up to 20 lots per day) and non-ferrous (up to 15 lots per day) are published separately.

If nothing is done

Excessive prices for buying and loading scrap make it unprofitable for buyers to participate in auctions, which reduces their efficiency. This year, auctions have been disrupted several times due to an insufficient number of participants. However, this is a long-standing and systemic problem. According to the results of tenders for the sale of scrap in the system “Prozorro.Sales” for 2017-2023, only 42% of them were successful.

The above-mentioned problems have been repeatedly voiced earlier, but have not been solved for a long time.

«Market participants have been drawing UZ’s attention to the lack of transparency of both the current auction mechanisms and lot pricing principles for a year now – not only verbally, but also in writing, literally describing all the disadvantages of the current auctions. But, unfortunately, there were no changes in the organization, prices and conditions of UZ auctions – both before and after the September meeting», – Valentyn Makarenko emphasizes.

According to Ivan Kovalevsky, the only thing that has changed is that Ukrainian Railways has reduced the cost of loading by UAH 200 per ton: previously it was UAH 1.4 thousand per ton, now it is about UAH 1.2 thousand. However, these changes cannot be called significant.

Against this background, there is a decrease in interest in bidding not only from steelmakers, but also from other market participants.

«We participate in the auction only when buying specialized types of scrap. We cannot sell this raw material on the domestic market because there is no economic feasibility in it. We export such scrap, and only then we get a certain margin,» explains Konstantin Bass.

Due to the disruption of trading, the fulfillment of Ukrainian Railways’ plans to sell scrap by the end of 2025 is in question. UZ seeks to occupy 8% of the scrap consumption market in Ukraine this year, which amounts to about 96,000 tons, with the forecast of raw material consumption in 2025 at the level of 1.2 million tons (expectations of the association “UAVtormet”). In June-August UZ sold 28.2 thousand tons of scrap, which is 1.8% of the expected level of consumption this year.

Even if UZ realizes its announced intentions to auction 12 thnd tons of scrap every month, the sales volume will reach 6.3%. But even this is difficult to achieve, as many auctions are disrupted, and the rate of actual shipments of sold goods to buyers is very low. This further kills the desire of potential buyers to come to auctions, because if they do not receive their goods on time, hardly anyone will dare to participate in new bidding.

Immediate solutions

Ukrainian steel companies are ready to continue purchasing raw materials from Ukrainian Railways on transparent and market terms. Ukrainian steelmakers have confirmed their monthly scrap requirements at 20,000 tons per month, which exceeds Ukrainian Railways’ stated sales plan for 2026 (200,000 tons).

To boost trading, Ukrainian Railways only needs to change the terms and conditions, making them more convenient for buyers and relevant to the current situation on the scrap market. This is especially true given that Ukrainian Railways has already had similar positive experiences in the past, when a series of decisions led to the “unfreezing” of raw material trading.

However, so far, Ukrainian Railways has limited itself to demonstrating its intention to meet the wishes of market participants. The first step can be interpreted as a reduction in the single price for loading services to UAH 1,143 per tonne including VAT, but so far, there have only been promises to periodically (?) update price lists, consider the possibility of providing FCA shipping terms, and introduce differentiated loading prices depending on the loading point and type of scrap.

There are just over two months left until the end of the year, and unfortunately, there is no sign of the trading conditions and market conditions converging. It is precisely this inflexibility that will prevent Ukrainian Railways from stepping up its auctions and attracting the funds so badly needed by the state-owned company to pay salaries and develop. In turn, the plans of steelmakers to secure raw materials for the autumn-winter period, which promises to be extremely difficult for the entire period of Ukraine’s independence, are also in question.